Integration Changes Annex V 1.8

Integration Changes Annex V 1.8

The following section documents the changes that must be taken into account according to the technical annex V1.8 established by Dian, among which are recorded Catalog Updates, New Rejection Rules and Changes in calculations:

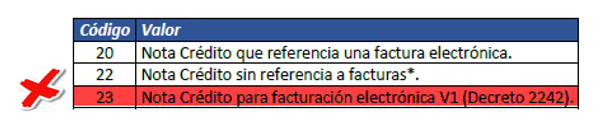

The reference to invoices is removed from the Post Validation model

Deleted:

| Code | Value |

|---|---|

| twenty | Credit Note that references an electronic invoice. |

| 22 | Credit Note without reference to invoices*. |

Deleted:

| Code | Value |

|---|---|

| 30 | Debit note that references an electronic invoice. |

| 32 | Debit note without reference to invoices*. |

Add Tax Identifier Type

Added:

- Code 47 PEP.

Which should be used only for the acquirer, because this type of document does not belong to the types of documents in the RUT database.

| Code | Value |

|---|---|

| 11 | Civil registry |

| 12 | ID card |

| 13 | Citizenship card |

| 21 | Immigration card |

| 22 | Immigration card |

| 31 | NIT |

| 41 | Passport |

| 42 | Foreign identification document |

| 47 | PEP |

| 50 | NIT from another country |

| 91 | NUIP* |

Add Operation Type

Added:

- Code 12 Transport.

- Code 13 Exchange.

| Code | Value |

|---|---|

| 10 | Standard* |

| 09 | AIU |

| 11 | Commands |

| 12 | Transportation |

| 13 | Exchange |

- (*) Default value

- (**) Value corresponding to the operations carried out by the cargo transportation sector.

- (***) Value corresponding to the operations carried out by the Foreign Exchange Intermediation Companies and Special Financial Services sector for the sale of foreign currency.

Add and Change Tax Names

Added:

- Code 08 Percentage IC.

- Code 30 IC Data.

It Change:

- ReteFuente name to ReteRenta Code “06”.

- Name of Bags to INC Bags Code “22”.

| Identifier | Name | Description |

|---|---|---|

| 01 | VAT | Value Added Tax |

| 02 | IC | Consumption Tax |

| 03 | ICA | Industry, Commerce and Notice Tax |

| 04 | INC | National Consumption Tax |

| 05 | ReteVAT | VAT withholding |

| 06 | ReteRenta | Income Withholding |

| 07 | ReteICA | Withholding on the ICA |

| 08 | Percent CI | Plastic Bag Consumption Tax |

| 20 | FtoHorticulture | Hortifruit Promotion Fee |

| 21 | Doorbell | Stamp Tax |

| 22 | INC Bags | National Plastic Bag Consumption Tax |

| 23 | INCarbon | National Carbon Tax |

| 24 | INCombustibles | National Fuel Tax |

| 25 | Fuel Surcharge | Fuel surtax |

| 26 | Sordicom | Retail contributions (Fuels) |

| 30 | IC Data | Data Consumption Tax |

| ZY | Does not cause | Not responsible for tax |

| ZZ | Name of the tax figure | Other taxes, fees, contributions, and similar |

- (*) In cases where the tax expressed in the list of this section is not available, the code ZZ must be used to report the tax, rates, contributions or similar and the taxpayer must indicate the corresponding information that applies.

- (**) The name of the tax figure is assigned by the biller and will not be a cause for rejection.

Change Legal Organization Type Name

It Change:

- Meaning of Legal Person to Legal Person and assimilated.

- Meaning of Natural Person to Natural Person and assimilated.

| Code | Meaning |

|---|---|

| 1 | Legal entity and similar entities |

| 2 | Natural and assimilated person |

Change Name of Tax Responsibilities

It Change:

- Meaning Not responsible a Not applicable-Other Code “R-99-PN”

| Code | Meaning |

|---|---|

| 0-13 | Big contributor |

| 0-15 | Self-retaining |

| 0-23 | Sales tax withholding agent |

| 0-47 | Simple Tax Regime – SIMPLE |

| R-99-PN | Not Applicable - Others |

Correction Concept for Credit Notes:

Added:

- Partial or total discount or discount.

- Price adjustment.

| Code | Description |

|---|---|

| 1 | Partial return of the goods and/or partial non-acceptance of the service |

| 2 | Electronic invoice cancellation |

| 3 | Rebate or partial or total discount |

| 4 | Price adjustment |

| 5 | Others |

Deleted:

- Total discount applied.

- Total discount applied.

- Rescission.

Discount Codes

It Change

- Meaning of Discount for tax assumed at Unconditional discount Code “00”

- Meaning of Pay one, get another to Conditional discount Code “01”

| Code | Meaning |

|---|---|

| 00 | Unconditional discount |

| 01 | Conditional Discount |

These codes are only used to categorize the type of discount granted. It is important that the biller mentions it in case he makes discounts for assumed taxes.

- (*) Unconditional discount is for discounts at the line level.

- (**) Conditional discount, these are discounts at the invoice footer level.

Deleted:

- Discount codes 02 to 11

Reference Price Code List

Deleted:

- Code 02.

- Code 03.

| Code | Meaning |

|---|---|

| 01 | Commercial value |

Note: For commercial samples or gifts, '01' must be sent in the field codigoTipoPrecio

List of values for reference prices, which must be reported when it comes to samples and/or gifts without commercial value.

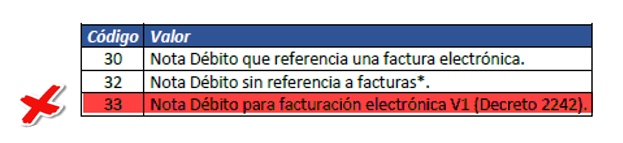

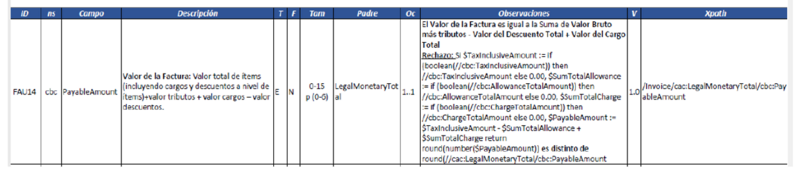

Tax Rate Tables

It Change

- Denomination ReteFuente for ReteRenta

Address Group

- Texts were adjusted in the observations of the fields corresponding to said group.

- The group becomes optional. If reported, it will be validated according to what is stipulated in the annex.

- The ID and CountrySubentityCode elements pass rejection when reporting the PhysicalLocation and RegistrationAddress groups.

- There will be cross-validations between the codes of the municipalities and the departments.

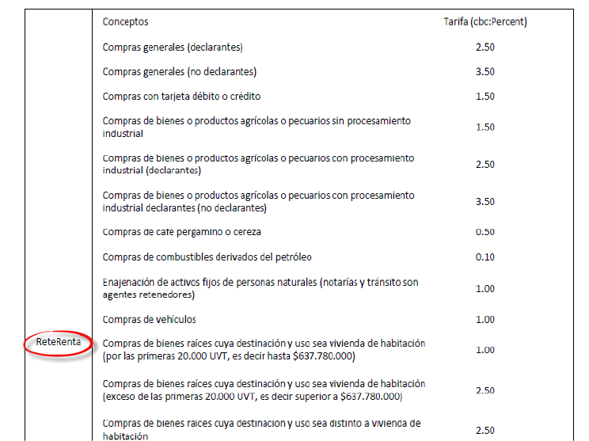

Advance invoice

- It is reported that as of the publication and entry into force of this annex, the advances will be indicated as informative values, therefore these values will not be included in the operation of the element PayableAmount (ID FAU14) on the total of the document or instrument electronic.

@IMPORTANT: The Advance becomes informative, and should not be taken into account in the total of the document.

Approximations of sales tax collected

As established in article 1.3.1.1.1. of Decree 1625 of 2016, Sole Regulatory on Tax Matters, “To facilitate the collection of sales tax when the value of the tax generated involves the payment of fractions of ten pesos ($ 10.00), said fraction may be approximated to a multiple of ten pesos ($10.00) nearest.”

That said, in the monetary values expressed in the cbc:TaxAmount elements, when the Value Added Tax – VAT is reported, a tolerance of plus or minus five pesos ($5.00) will be allowed for the approximation to the multiple of ten pesos ($10.00 ) closest.

The approximations of the sales tax collected that this article deals with apply to the electronic sales invoice, debit notes, credit notes and other electronic documents that are derived from the electronic sales invoice, in relation to sales tax. sales.

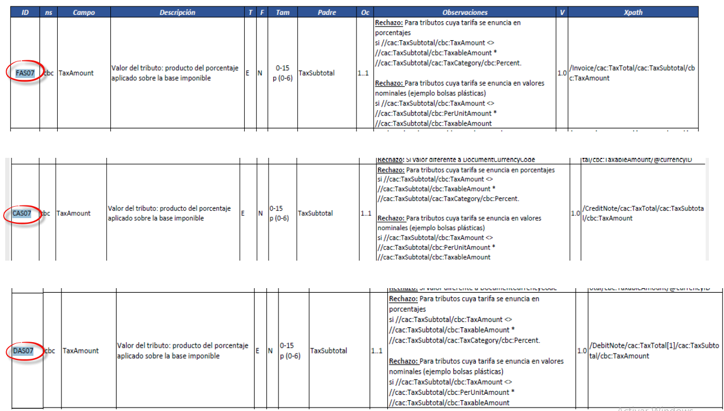

Changes in the operation for calculations of taxes per nominal unit for the rules

FAS07, CAS07, DAS07

<general taxes> <TaxInvoice> <TaxbaseTOTALImp>1003.00</TaxbaseTOTALImp> <TOTALImp code>01</TOTALImp code> <percentageTOTALImp>19.00</percentageTOTALImp> <unitMeasure>WSD</unitMeasure> <TOTALImp value>190.57</TOTALImp value> </TaxInvoice> </general taxes> <totaltaxes> <TotalTaxes> <TOTALImp code>01</TOTALImp code> <totalamount>190.57</totalamount> </TotalTaxes> </totaltaxes>

<InvoiceDetail>

<realamount>1.00</realamount>

<realUnitMeasureQuantity>94</realUnitMeasureQuantity>

<quantityUnits>2.00</quantityUnits>

<productcode>BAG</productcode>

<PriceTypecode>01</PriceTypecode>

<description>Bag </description>

<technical description>Plastic Bag</technical description>

<standardCode>999</standardCode>

<standardCode>999</standardCode>

<standardProductCode>Bag</standardProductCode>

<taxDetails>

<TaxInvoice>

<TaxbaseTOTALImp>0.00</TaxbaseTOTALImp>

<TOTALImp code>22</TOTALImp code>

<internalcontrol/>

<percentTOTALImp>0.00</percentageTOTALImp>

<unitMeasure>94</unitMeasure>

<TributeMeasureUnit>40.00</TributeMeasureUnit>

<valueTOTALImp>80.00</valueTOTALImp>

<UnitTributeValue>40.00</UnitTributeValue>

</TaxInvoice>

</taxDetails>

<totaltaxes>

<TotalTaxes>

<TOTALImp code>22</TOTALImp code>

<totalamount>80.00</totalamount>

</TotalTaxes>

</totaltaxes>

<FreeSample>0</FreeSample>

<ReferencePrice>40.00</ReferencePrice>

<totalprice>80.00</totalprice>

<TotalPriceWithoutTaxes>0.00</TotalPriceWithoutTaxes>

<UnitSalePrice>0.00</UnitSalePrice>

<sequence>3</sequence>

<unitMeasure>94</unitMeasure>

</InvoiceDetail>

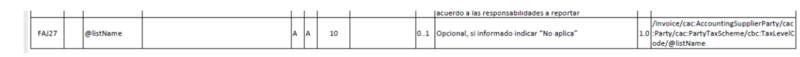

@listName attribute

The @listName attribute of the cbc:TaxLevelCode field is removed (Issuer Regime, Acquirer, Conveyor, Consortium Issuer).

It is optional, if informed, to indicate “Not applicable” (affecting Rules FAJ27, FAJ63, FAK27, FAM38, CAJ27, CAJ63, FAK27, CAM38, DAJ27, DAK27),

<responsibilitiesRut> <Obligations> <obligations>R-99-PN</obligations> <regime>Not applicable</regime> </Obligations> </responsibilitiesRut>

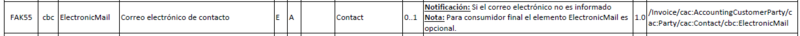

End Consumer Email

The email when you are a final consumer is optional: affected rule FAK55

<client> <recipient> <Recipient> <DeliveryChannel>0</DeliveryChannel> <email> <arr:string>email1@thefactoryhka.com</arr:string> </email> </Recipient> </recipient> <tax details> <Tributes> <taxcode>ZY</taxcode> </Tributes> </tax details> <!--THIS FIELD IS OPTIONAL--> <email>OptionalField@thefactoryhka.com</email> <SocialReasonName>The Factory HKA Colombia</SocialReasonName> <notify>YES</notify> <documentnumber>22222222</documentnumber> <responsibilitiesRut> <Obligations> <obligations>R-99-PN</obligations> <regime>49</regime> </Obligations> </responsibilitiesRut> <identificationtype>31</identificationtype> <persontype>1</persontype> </client>

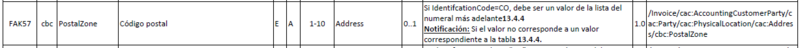

Postal Code of the Purchaser's address

The postal code is a numerical or alphanumeric structure that is assigned to a geographic area of a country and facilitates the delivery of correspondence, because it identifies each destination with a unique number. It does not replace the address, but rather complements it to facilitate the delivery of a shipment.

In Colombia the postal code consists of 6 digits (example: 578986) that initially indicate the geographical position, followed by the routing and finally the one that places us within the postal area, like this:

National Departments

The first two digits represent the national departments, using the current Dane coding. Codes less than 10 must start with a leading zero.

Departmental postal routing zones

The third and fourth positions define the postal routing zones to facilitate classification through the Postal Code: 00 is reserved for the capital of the department. From 01 to 89 allows each department to be divided into up to 89 postal routing zones.

Postal district by municipality or locality

The last two positions of the National Postal Code allow one hundred postal districts to be assigned to each of the ten postal zones created in each department. That is, up to a thousand different districts can be assigned to each department, for a total of thirty-three thousand at the national level.

The table of postal codes is left as it corresponds to the original, whose official source is www.codigopostal.gov.co and the table with the codes is found in the Toolbox “Caja_de_herramientas_Factura_Electronica_Validacion_Previa.zip\Anexo Técnico\”, in Excel format “Postal_Codes.xlsx” where the codes must be used

xlsx” where the codes found in column E must be used.

Transport Sector

The type of operation “12” must be reported to have the validations described in this section and corresponds to the cargo transportation sector when these are registered in the RNDC.

| Code | Value |

|---|---|

| 10 | Standard* |

| 09 | AIU |

| 11 | Commands |

| 12 | Transportation |

| 13 | Exchange |

The Ministry of Transportation requires additional information in the preparation of electronic documents for the implementation of its sector. It has the following definitions for the groups, elements or attributes to be used:

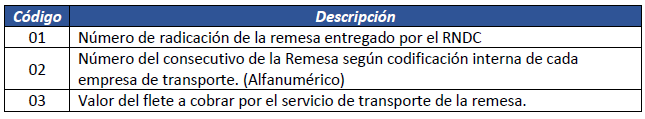

1) Filed Consignment Acceptance Number: This is a unique national consecutive number controlled by the RNDC and which is delivered to the transport company as a sign of acceptance that the data sent has no errors. It is a numerical data from 1 to 100,000 million, today in the RNDC it is 65 million consecutively.

2) Consignment Number: This is an internal consecutive number that each transport company has. The RNDC does not control ranges. The company can handle prefixes. It is alphanumeric data of up to 15 characters.

3) Quantity transported: It is a numerical data without decimals.

4) Unit of measurement: One of the two encodings allowed by the standard of this document will be used:

- KGM: Kilograms

- GLL: Gallons.

5) Freight value: Numerical data without decimals. It is the freight value defined for the shipment.

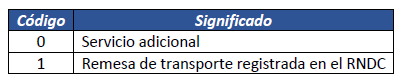

6) Service type: An integer numerical data to define the type of related service

- 0: It is an additional service provided that is not included in the freight of the shipment.

- 1: It is a Transport Consignment registered with the RNDC.

7) Purchase order: Service order number or purchase or referral order number according to the Generator's consecutive number. Multiple service orders or Generator referrals can be specified.

The following paragraphs are incorporated to incorporate the additional information required by the sector:

13.5.1. Transport Registration: @schemeID

List of values for identification at the line level if the Good or Service “B/S” reported corresponds or not to a line registered in the RNDC.

13.5.2. Consignment Transport: cbc:Name

List of values corresponding to the Cargo Transportation Sector to report the concepts indicated in the “Description” column.

Copyright © 2016 The Factory HKA. All rights reserved.