Healthy Taxes

Sumario

Tax Statute - Article 513

In accordance with article 513 of the Tax Statute, entitled “Healthy Taxes”, which establishes the regulatory parameters to report taxes on Ultra-processed Sugary Beverages and Ultra-processed Foods in the case in which the product applies

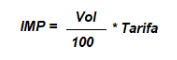

Article 513-3: Taxable Base of the Tax on Ultra-processed Sugary Beverages.

The tax base for the tax on ultra-processed sugary beverages is the content in grams (g) of sugar per one hundred milliliters (100 ml) of beverage, or its equivalent, produced by the producer or imported by the importer.

Where:'

IMP': Amount of tax applicable to the beverage, in pesos.

Vol': Volume of the drink, expressed in milliliters (ml).

Rate': Tax rate, as determined in the table above.

Article 513-6: Tax on Industrially Ultra-Processed Edible Products and/or High Content of Added Sugars, Sodium or Saturated Fats.

The fact generating the tax on industrially ultra-processed edible products and/or with a high content of added sugars, sodium or saturated fats is constituted by:

- In the production, sale, withdrawal of inventories or acts that involve the transfer of ownership for free or for consideration.

- Import. Ultra-processed edible products that have added sugar, salt/sodium and/or fat as ingredients and their content in the nutritional table exceeds the following values will be subject to this tax:

| Nutrient | For every 100gr |

|---|---|

| sodium | > = 1 mg/kcal year > = 300 mg/100 g. |

| sugars | >= 10% of total energy from free sugars. |

| Saturated fats | >= 10% of total energy from saturated fats. |

PARAGRAPH 1o. To calculate the percentages established in the table referred to in section 2 of this Article, the following must be taken into account:

- A) Audio:

- First formula:

Where:'

S': Audio

KCAL': Calorie content.

- Second formula:

Where:'

S': Audio

P'': Serving (net weight)

It is sufficient that one of the two conditions is met to be subject to the tax.

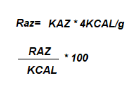

- B) Sugars:

Where:'

KAZ': Amount of sugar

4Kcal/g': Sugar conversion factor

RAZ': Result of the previous calculation.

KCAL': Amount of calories reported.

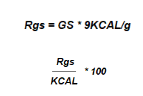

- C) Saturated fats:

Where:'

G5': Saturated fats

9KCAL/g': Fat conversion factor.

Rgs': Previous calculation result.

KCAL': Amount of calories reported

Current Status

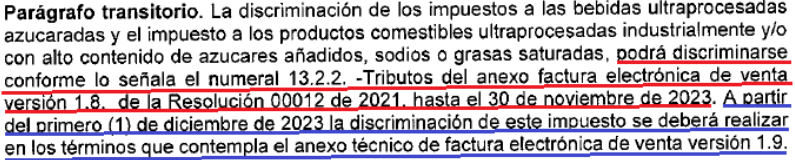

- Annex 1.9: Based on the provisions of resolution DIAN 000165 of November 1, 2023, Article 62 transitional paragraph, which indicates the following:

The following specific codes are available to report as healthy taxes apply:

| Identification | Name | Description |

|---|---|---|

| 3. 4 | IBUA | Tax on ultra-processed sugary drinks |

| 35 | ICUI | Tax on ultra-industrially processed edible products and/or with a high content of added sugars, sodium or saturated fats. |

Structure

The structure for Ultra-Processed Sugary Beverages to be reported will be:

- Level of detail:

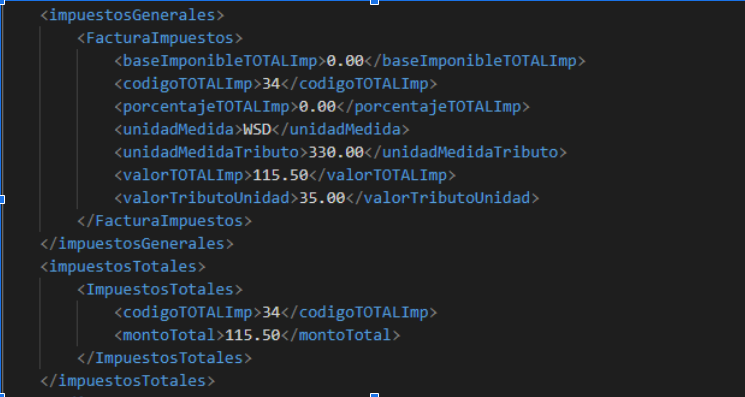

- General level:

The structure for Ultra-processed Foods to report will be:

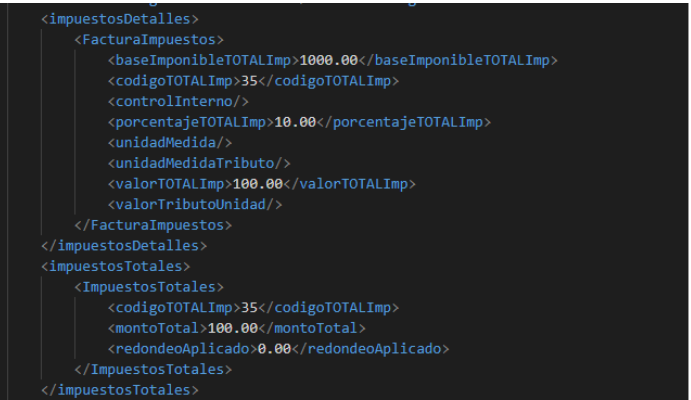

- Level of detail:

- General level:

Taking into account the fields referring to Annex 1.8 that currently applies, you can find the SOAP examples by clicking on the following link: