Graphic Representations in the Issuance process - Direct Integration Manual Index - Electronic Invoice

Sumario

- 1 Minimum requirements for graphical representations of electronic invoices according to article 29 of resolution 00042 of 05-05-2020, based on the electronic invoice requirements contemplated in article 11 of the same resolution.

- 2 How field 333221 is generated.

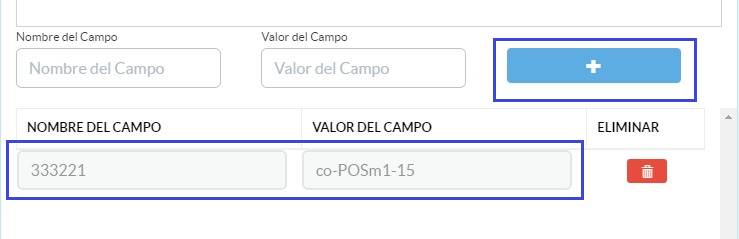

- 3 Reference model for graphical representation of electronic invoice printed on electronic invoice strip.< /font>

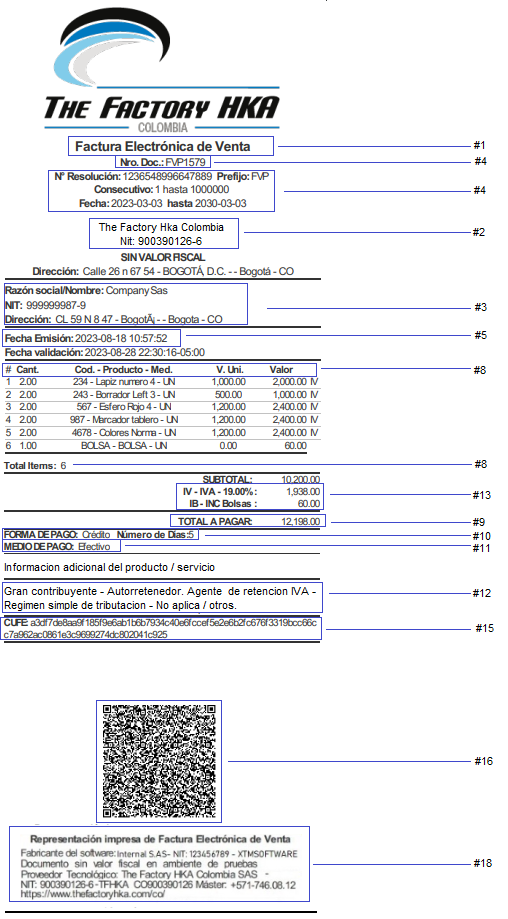

- 4 Reference model for graphical representation of electronic invoice in letter size.

Minimum requirements for graphical representations of electronic invoices according to article 29 of resolution 00042 of 05-05-2020, based on the electronic invoice requirements contemplated in article 11 of the same resolution.

Paragraph 1. For the purposes of graphic representations in digital format, electronic billers must use formats that are easy and widely accessible by the acquirer, guaranteeing that the invoice can be read, copied, downloaded and printed, without having to go to other sources. sources to provide the necessary applications for this.

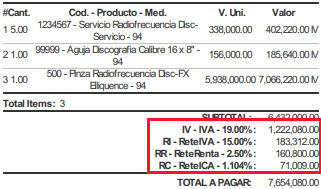

Graphic representations in digital or printed format must contain at least the requirements of sections 1 to 5, 8 to 13, 15 and 18 of article 11 of this resolution.

1. In accordance with literal a) of article 617 of the Tax Statute, be expressly called an electronic sales invoice.

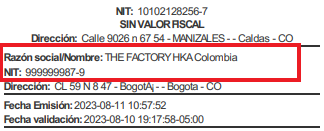

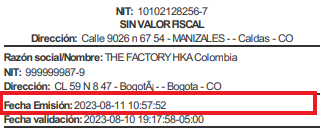

2. In accordance with literal b) of article 617 of the Tax Statute, it must contain: surnames and first name or company name and Tax Identification Number -NIT of the seller or the person providing the service.

3. Identification of the acquirer, as applicable, as follows:

- a) In accordance with literal c) of article 617 of the Tax Statute, it must contain: surnames and first name or company name and Tax Identification Number – NIT of the purchaser of the goods and services.

- b) Register surnames and name and identification number of the purchaser of the goods and/or services; for cases in which the acquirer does not provide the information in literal a) of this section, in relation to the Tax Identification Number -NIT.

- c) Register the phrase "final consumer" or surname and first name and the number "222222222222" in the case of purchasers of goods and/or services who do not provide the information in literals a) or, b) of this numeral.

- The address of the place of delivery of the good and/or provision of the service must be recorded, when the aforementioned sales operation is carried out outside the business headquarters, office or premises of the electronic biller for cases in which the identification of the purchaser, corresponds to that indicated in literals b) and c) of this section.

4. In accordance with the provisions of literal d) of article 617 of the Tax Statute, you must carry a number that corresponds to a consecutive numbering system for electronic invoices sale, including the number, range, date and validity of the numbering authorized by the Unit Special Administrative Directorate of National Taxes and Customs -DIAN.

5. Generation date and time

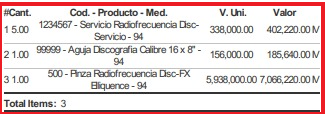

8. In accordance with literal f) of article 617 of the Tax Statute, indicate the registration number, line or items, the total number of lines or items in which the quantity, unit of measure, specific description and unambiguous codes that allow the identification of the goods sold or services provided, the name -covered good- when they are the goods sold of article 24 of Law 2010 of 2010, the taxes referred to in paragraph 13 of this article when applicable, as well as the unit value and the total value of each of the lines or items.

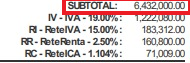

9. In accordance with the provisions of literal g) of article 617 of the Tax Statute, the total value of the sale of goods or provision of services, as a result of the sum of each of the lines or items that make up the electronic sales invoice.

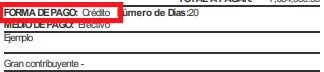

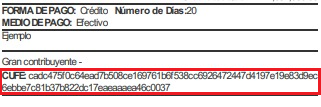

10. The form of payment, establishing whether it is cash or credit, in the latter case it must be indicated the term.

11. The means of payment, recording whether it is cash, credit card, debit card or transfer electronic or other means that applies. This requirement applies when the payment method is cash.

12. In accordance with the provisions of literal i) of article 617 of the Tax Statute, indicate the as a withholding agent of the Sales Tax -VAT, as a self-withholding agent of the Tax on Income and Complementary, large taxpayer and/or taxpayer of the unified tax under the simple tax regime – SIMPLE, when applicable.

13. In accordance with the provisions of literal c) of article 617 of the Tax Statute, the discrimination of Sales Tax -VAT, National Consumption Tax, Tax National Consumption of Plastic Bags, with its corresponding rate applicable to the goods and/or services that are subject to these taxes.

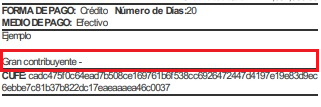

15. The Unique Electronic Invoice Code -CUFE-.

18. Surname and first name or company name and Tax Identification Number -NIT, of the software manufacturer, the name of the software and the technology provider, if any.

16. For the purposes of numeral 16 of article 11 of this resolution, the Quick Response Code -QR Code- must be included, in accordance with the conditions, terms and technical and technological mechanisms established by the Administrative Unit Special Directorate of National Taxes and Customs -DIAN, in the "Technical Annex of the electronic sales invoice".

The minimum size that the quick response or QR code must have is 2cm to facilitate reading

by different devices as shown below

The graphic representation can be designed according to the needs of the OFE (Obliged to Invoice Electronically); Since the generation is in XML format, then any computer tool for converting this format to .pdf, .docx, or other digital formats will be sufficient to comply with the provisions of current regulations. The requirement

What you must comply with is the inclusion of the quick response or QR code as specified above.

An alternative to digital formats is printing on paper the graphic representation designed according to the needs of the OFE. The requirement that must be met is

inclusion of the quick response or QR code as specified above.

The graphic representation must include the QR code on all pages of the digital formats and the paper print of the electronic invoice. The graphic representation will always be “a representation, an image” of the information contained in the XML format of the commercial transaction profiles for the DIAN. This means that the electronic document will always be the one that has legal value for the national authorities.

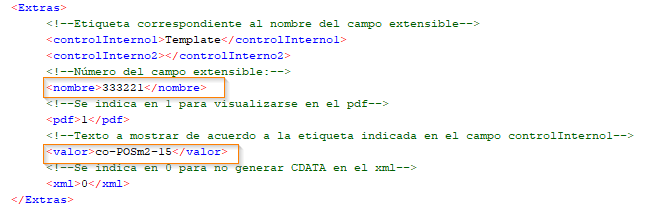

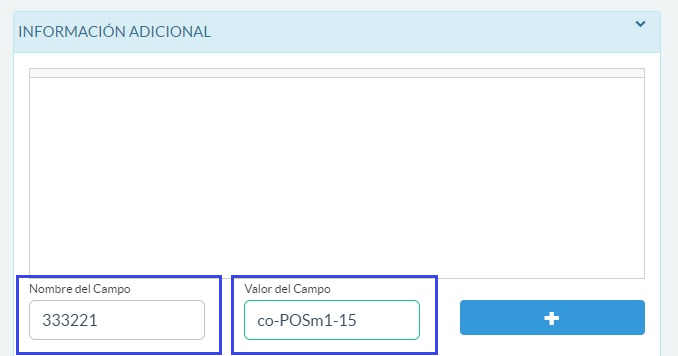

How field 333221 is generated.

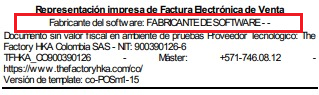

This is an extensible field where we include the version of the template that we want to generate. To use this field, you must take into account that field 333221 is being sent in the xml or ERP system. It must be taken into account that the process of issuing an electronic billing ends with the delivery of the document to the acquirer's email. Likewise, so that the PDF that reaches the purchaser by email is as similar as possible to the strip or ticket delivered at the point of sale, The Factory HKA implemented the following TEMPLATES in a DEMO environment:

With 80 mm dimension: co-POSm1-15

With 58 mm dimension: co-POSm2-15

It must be sent as follows:

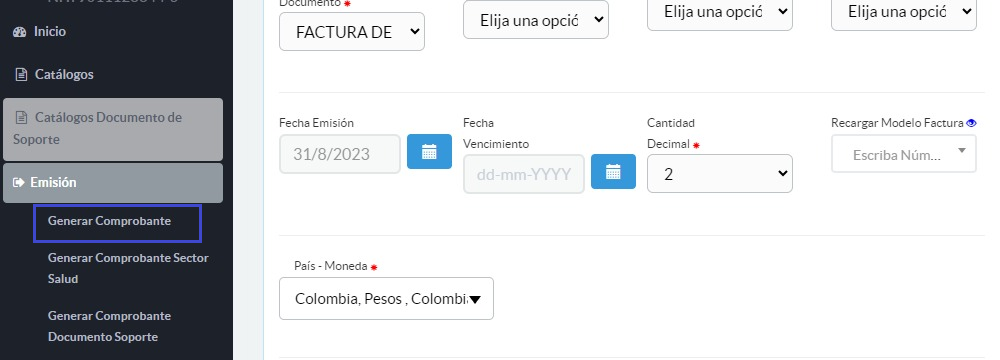

How is this extensible field sent by portal

This extendable field can be sent through the portal as follows:

1. Enter the portal https://demofactura.thefactoryhka.com.co/invoices

2. Go to issue and then generate receipt.

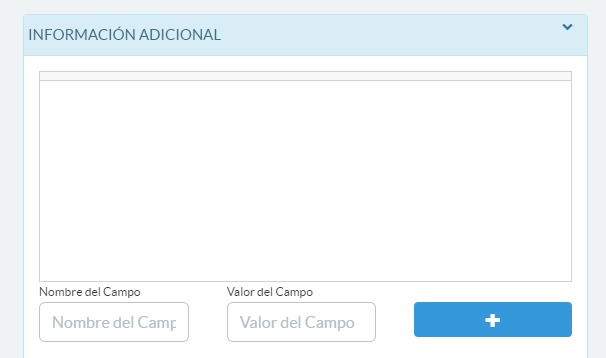

3. at the bottom the additional information node with the name and value fields is enabled.

4. In the field name part assign 333221 and in the field value add POSm2-15 With 58 mm dimension or co-POSm1-15 With 80 mm dimension.

5. Click on the "+" box to assign this extendable field.

Reference model for graphical representation of electronic invoice printed on electronic invoice strip. < /font>

Reference model for graphical representation of electronic invoice in letter size.

Copyright © 2016 The Factory HKA. All rights reserved.