Integration Changes -Integration Changes Annex V 1.9

Sumario

- 1 Resolution 165 Technical Annex 1.9

- 2 Separation of catalogs from the technical annex

- 3 Rounding to the total tax is eliminated at the detail and total level for invoices, credit and debit notes:

- 4 The 10 days after and below the date rule has been removed and a new rejection rule has been added.

- 5 Payment methods.

- 6 Name or company name of the issuer must match that reported in the RUT.

- 7 The PPT document type is created.

- 8 Export invoice.

- 9 New operation types.

- 10 Changes incorporated in the credit notes.

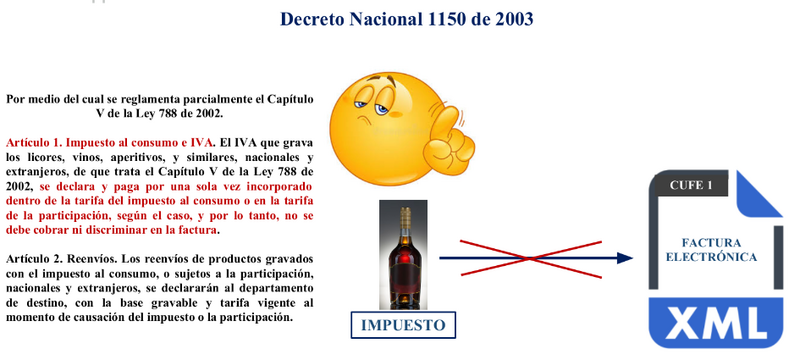

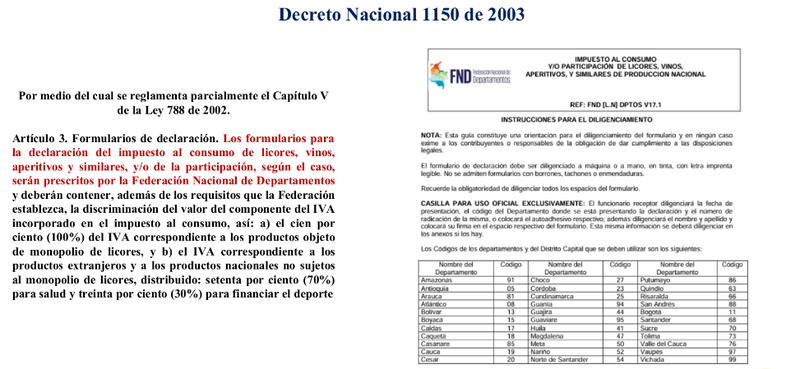

- 11 Tax on the Consumption of Liquor, Wine, Appetizers and Similar.

Resolution 165 Technical Annex 1.9

The technical annex, which forms an essential part of this resolution, must be implemented compulsorily by issuers of electronic invoices as of February 2, 2024. A period is given until said date to carry out the necessary adjustments in their information systems, complying with the provisions of this resolution, the most relevant changes are reported below.

Separation of catalogs from the technical annex

As part of the review process, the decision has been made to remove the data catalogs from the annex. This adjustment is intended to facilitate the modification of values in a more agile and efficient way. Going forward, these catalogs will remain outside the annex and will be available in a separate toolbox. In addition, a catalog updating process will be established independently of current resolutions.

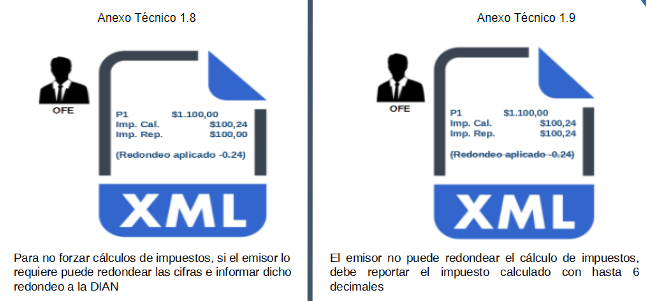

Rounding to the total tax is eliminated at the detail and total level for invoices, credit and debit notes:

Rules removed:

FAS18, CAS18,DAS18:

Rounding applied to the total tax at the InvoiceGeneral, credit note, debit note level (the RoundingAmount attribute of theTaxTotal node that belongs to the Invoice/CreditNote/DebitNote would not be handled)

FAX18, CAX18,DAX18:

Rounding applied to the total tax at the InvoiceDetail, credit note, debit note level (the RoundingAmount attribute of theTaxTotal node that belongs to the InvoiceLine/CreditNoteLine/DebitNoteLine would not be handled)

The 10 days after and below the date rule has been removed and a new rejection rule has been added.

Rules removed:

FAD09c, CAD09c, DAD09c:

The issue date cannot be less than 10 calendar days from the current date

FAD09d, CAD09d, DAD09d:

The issue date is not later than 10 calendar days from the current date

New rules:

FAD09e, CAD09e, DAD09e

Validates that generation date is equal to the signature date, applies to invoices, credit and debit notes

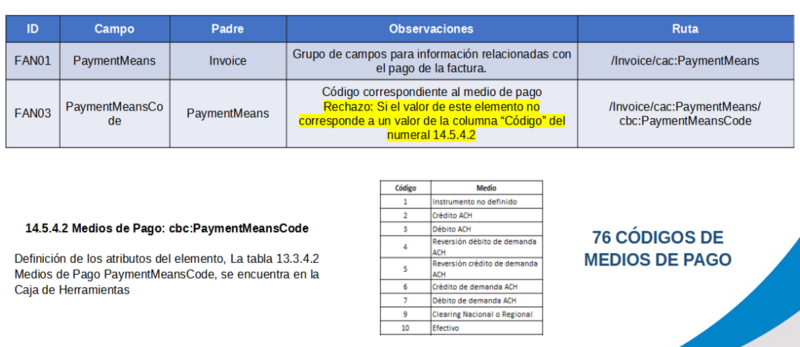

Payment methods.

Previously, it was mandatory to indicate the means of payment only on cash invoices. However, according to Annex 1.9, this obligation will extend to both cash and credit invoices.

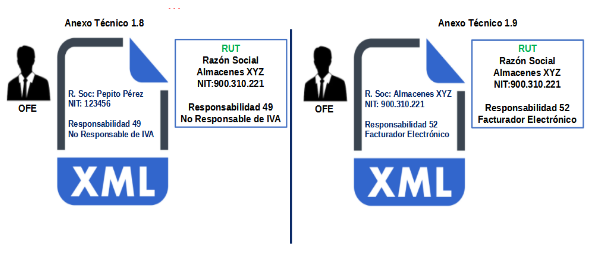

Name or company name of the issuer must match that reported in the RUT.

A validation will be carried out to ensure that the Tax Identification Number (NIT) and the name of the issuer of the invoices match the data registered in the Single Tax Registry (RUT), both in the issuing and receiving processes. of said invoices.

New rules:

FAJ44a: NIT not authorized to invoice electronically

FAJ43b: Name or Company Name of the issuer must correspond to that reported in the RUT and must coincide with the NIT reported

FAJ44b: NIT or identification document of the issuer must correspond to the one reported in the RUT and must coincide with the Company Name or registered commercial name.

FAJ43a: Name or Company Name of the issuer must be informed

The PPT document type is created.

Within the document type catalog, PPT (Temporary Protection Permit) is created with code 48, which is an identification document for people in human mobility from Venezuela, this document allows you to apply to the state's social programs, and access broadly to the right broad to rights such as health, education and work.

| Code | Meaning |

|---|---|

| 48 | PPT (Temporary Protection Permit) |

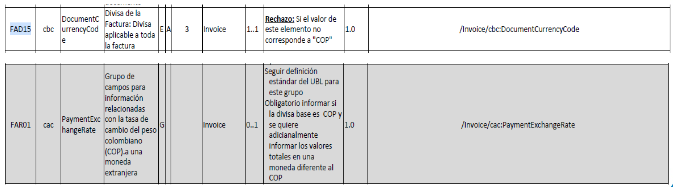

Export invoice.

Export invoices must be expressed in COP and an XML segment is created to put the values in another currency, it can be placed in both currencies in the graphic representation (a structure will be sent in the extensible so that it can be seen in the RG)

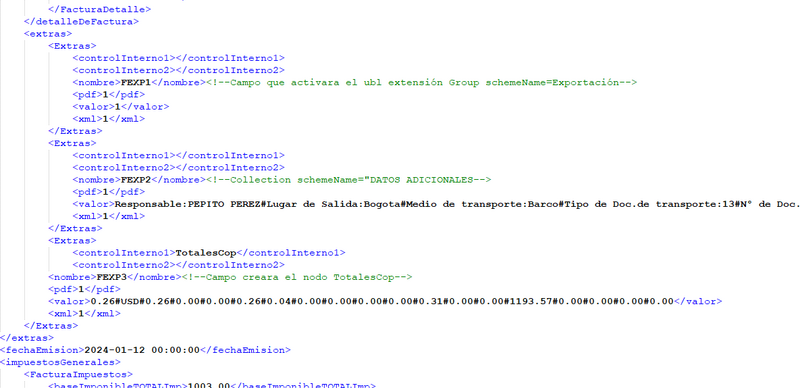

If you want to use the graphical representation generated by the system for export invoices, you must inform the UBLExtension “interoperability” so that the graphical representation shows the values of the exchange rate of the currency other than the COP, this is must be done through 3 extra fields as shown in the following image:

New operation types.

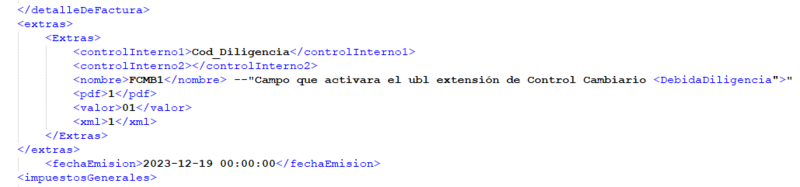

For exchange control, two operating modes are included (Currency Purchase and Currency Sale) with codes 15 and 16 respectively.

| Annex 1.9 01-11-2023 - 13.1.5. Types of operation

For Invoices:

| |||||||||||||||||

When one of these codes is reported in the CustomizationID, the UBL extension must be reported.

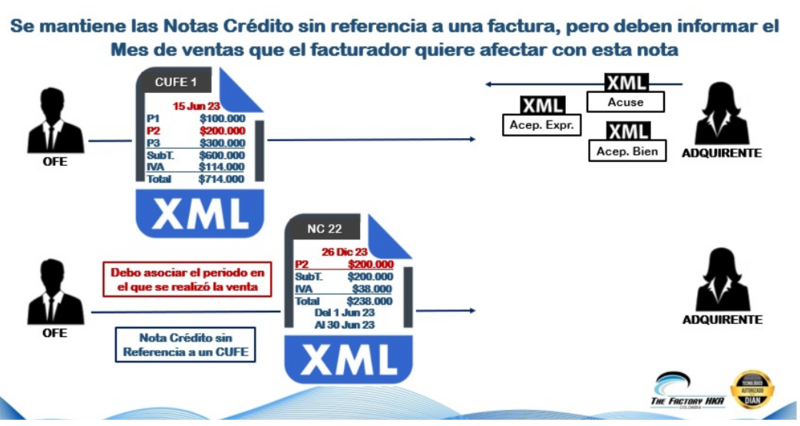

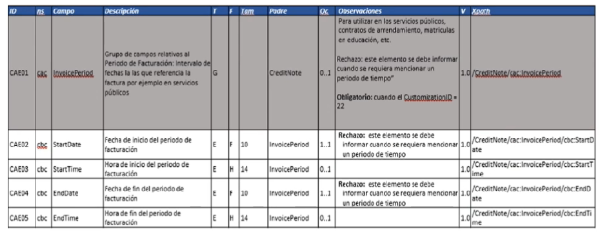

Changes incorporated in the credit notes.

Tax on the Consumption of Liquor, Wine, Appetizers and Similar.